Understanding USA Stock Valuation: Key Insights for Investors

Investing in the stock market requires a comprehensive understanding of various factors that influence stock prices. One crucial aspect is stock valuation, which plays a pivotal role in making informed investment decisions in the dynamic landscape of the USA stock market.

The Importance of Stock Valuation

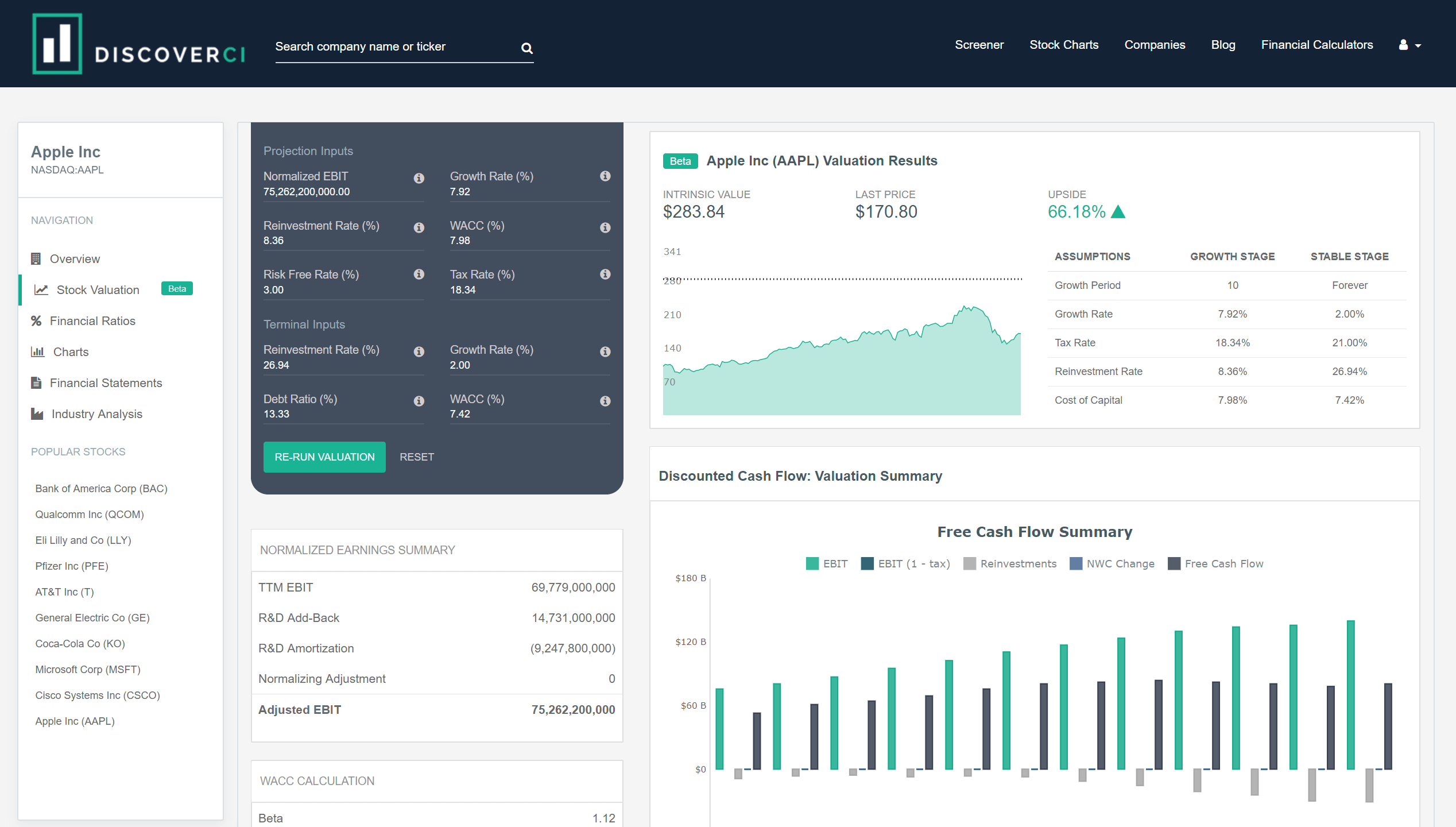

Stock valuation is the process of determining the intrinsic value of a stock by evaluating relevant financial metrics and market trends. Investors use various methods, such as the discounted cash flow (DCF) model and comparable company analysis (CCA), to assess whether a stock is undervalued or overvalued. By understanding the significance of stock valuation, investors can identify opportunities and manage risks effectively.

Key Metrics in USA Stock Valuation

Several key metrics are instrumental in the stock valuation process. Earnings per share (EPS), price-to-earnings (P/E) ratio, and book value are among the essential indicators. EPS reflects a company’s profitability, while the P/E ratio compares a stock’s current price to its earnings. Book value, on the other hand, represents the net asset value of a company. Investors should analyze these metrics collectively to gain a holistic view of a stock’s financial health.

Market Trends and Industry Analysis

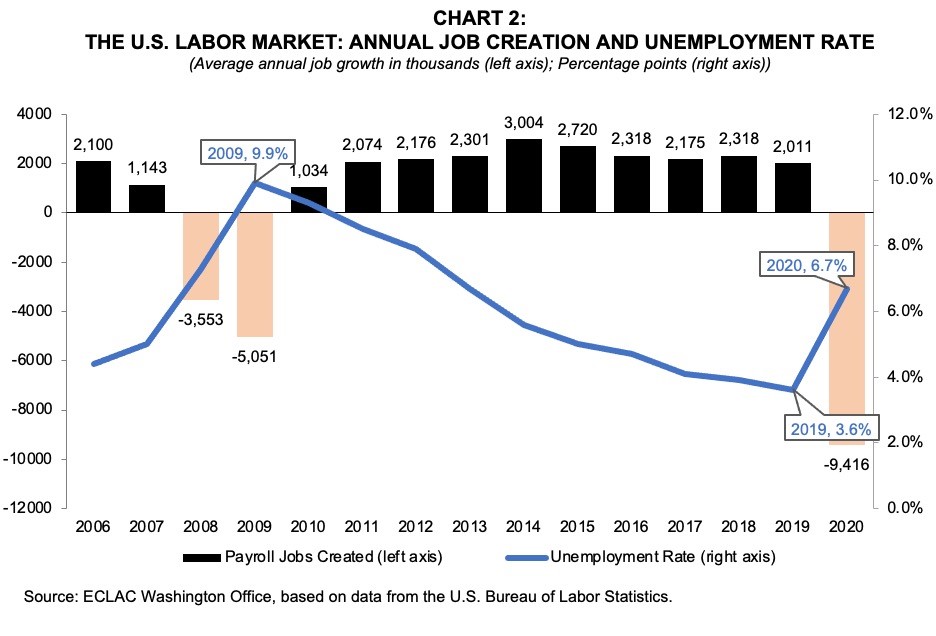

To grasp the nuances of stock valuation in the USA, investors must stay abreast of market trends and industry developments. Economic indicators, sector performance, and global events can significantly impact stock prices. Conducting thorough industry analysis enables investors to contextualize stock valuation within broader economic and market dynamics.

Risk Management Strategies

Understanding the risks associated with stock investments is integral to successful portfolio management. Market volatility, economic downturns, and geopolitical events can all influence stock prices. Implementing risk management strategies, such as diversification and setting stop-loss orders, helps investors navigate uncertainties and protect their investment portfolios.

Long-Term vs. Short-Term Investment Approaches

Investors often grapple with the decision of adopting a long-term or short-term investment approach. Long-term investors focus on the fundamentals of a company and its growth potential, while short-term investors capitalize on market fluctuations for quick gains. The choice between these approaches depends on individual risk tolerance, financial goals, and time horizons.

Utilizing Technology in Stock Valuation

In the digital age, technology plays a pivotal role in stock valuation. Advanced analytics, machine learning algorithms, and financial modeling tools empower investors to analyze vast amounts of data efficiently. Platforms like CleverScale offer valuable insights into USA Stock Valuation, allowing investors to make data-driven decisions.

The Role of CleverScale in Stock Valuation

CleverScale, a leading platform in stock valuation, provides comprehensive tools and analytics for investors navigating the USA stock market. By leveraging CleverScale’s services, investors can access real-time data, in-depth analysis, and reliable valuation metrics. The platform’s user-friendly interface makes it a valuable resource for both seasoned investors and those new to stock valuation.

In conclusion, understanding USA Stock Valuation is imperative for investors seeking to make informed decisions in the dynamic and competitive stock market. By delving into key metrics, staying abreast of market trends, and utilizing advanced technology platforms like CleverScale, investors can enhance their ability to navigate the complexities of stock valuation and achieve their financial objectives.