Pioneering Sustainability: Unveiling Green Finance Initiatives in the USA

As environmental consciousness takes center stage, the financial sector in the United States is witnessing a transformative shift toward green finance initiatives. This article explores the burgeoning landscape of sustainable finance in the USA, highlighting key initiatives, benefits, and the role individuals play in fostering environmental sustainability.

Understanding Green Finance: A Holistic Approach

Green finance goes beyond traditional financial practices, incorporating environmental, social, and governance (ESG) criteria into decision-making processes. In the USA, financial institutions are increasingly adopting a holistic approach that considers the impact of investments on the planet and society. This marks a departure from conventional practices and aligns with the growing global focus on sustainability.

Renewable Energy Investments: Powering a Sustainable Future

One of the prominent areas within green finance initiatives in the USA is the surge in renewable energy investments. Financial institutions are channeling funds into solar, wind, and other clean energy projects. This not only promotes the transition to sustainable energy sources but also contributes to reducing carbon footprints and mitigating the impact of climate change.

Sustainable Infrastructure Development: Building for Tomorrow

Green finance initiatives extend to sustainable infrastructure development, encompassing projects that prioritize environmental and social responsibility. In the USA, investments in green buildings, eco-friendly transportation systems, and resilient urban planning are gaining momentum. Such initiatives aim to create infrastructure that is not only functional but also environmentally conscious.

ESG Integration in Investment Strategies: Responsible Investment Choices

Environmental, social, and governance (ESG) considerations are becoming integral to investment strategies in the USA. Investors are increasingly seeking opportunities that align with sustainable practices, reflecting a broader shift toward responsible investing. Companies with strong ESG performance are viewed favorably by investors, indicating a growing awareness of the importance of ethical business practices.

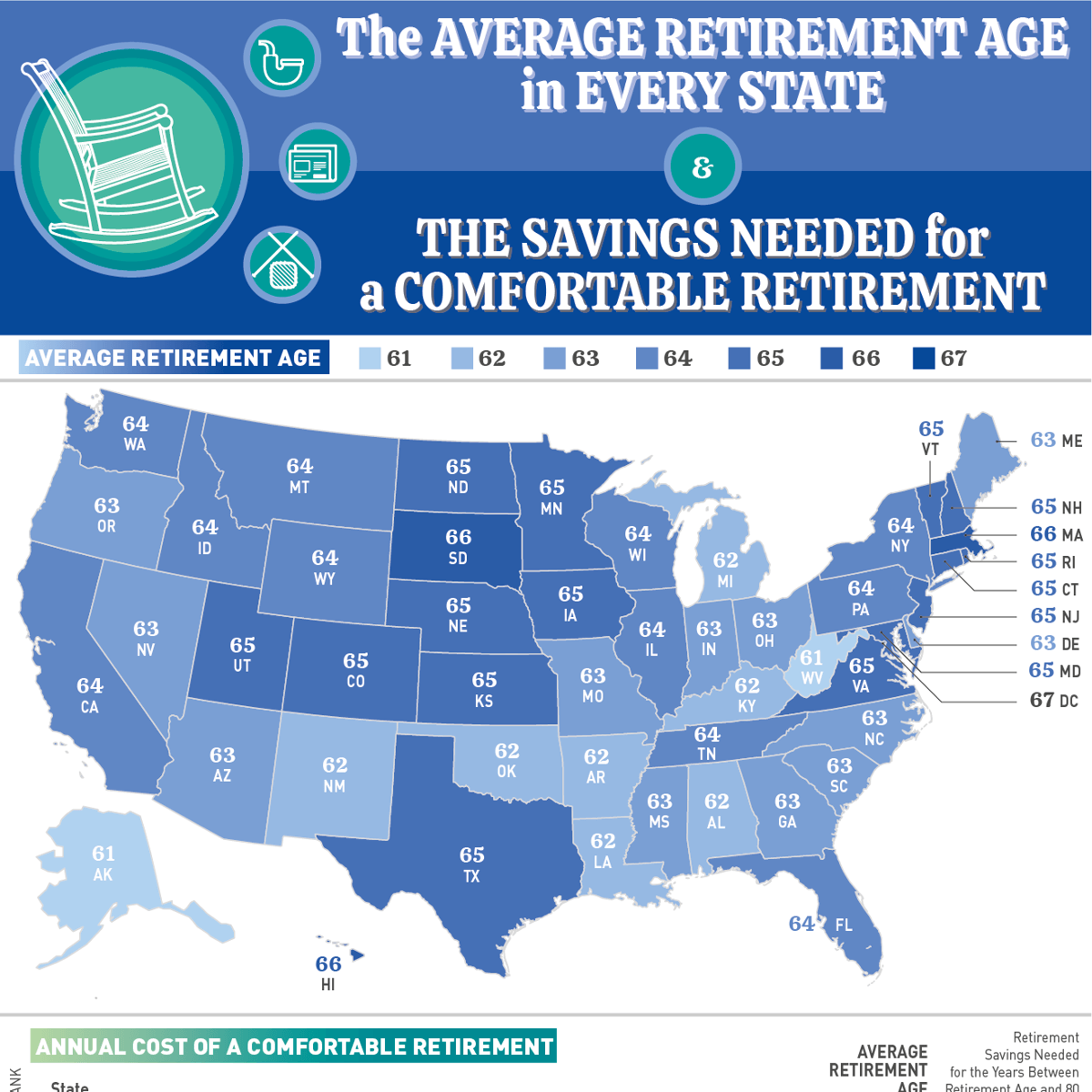

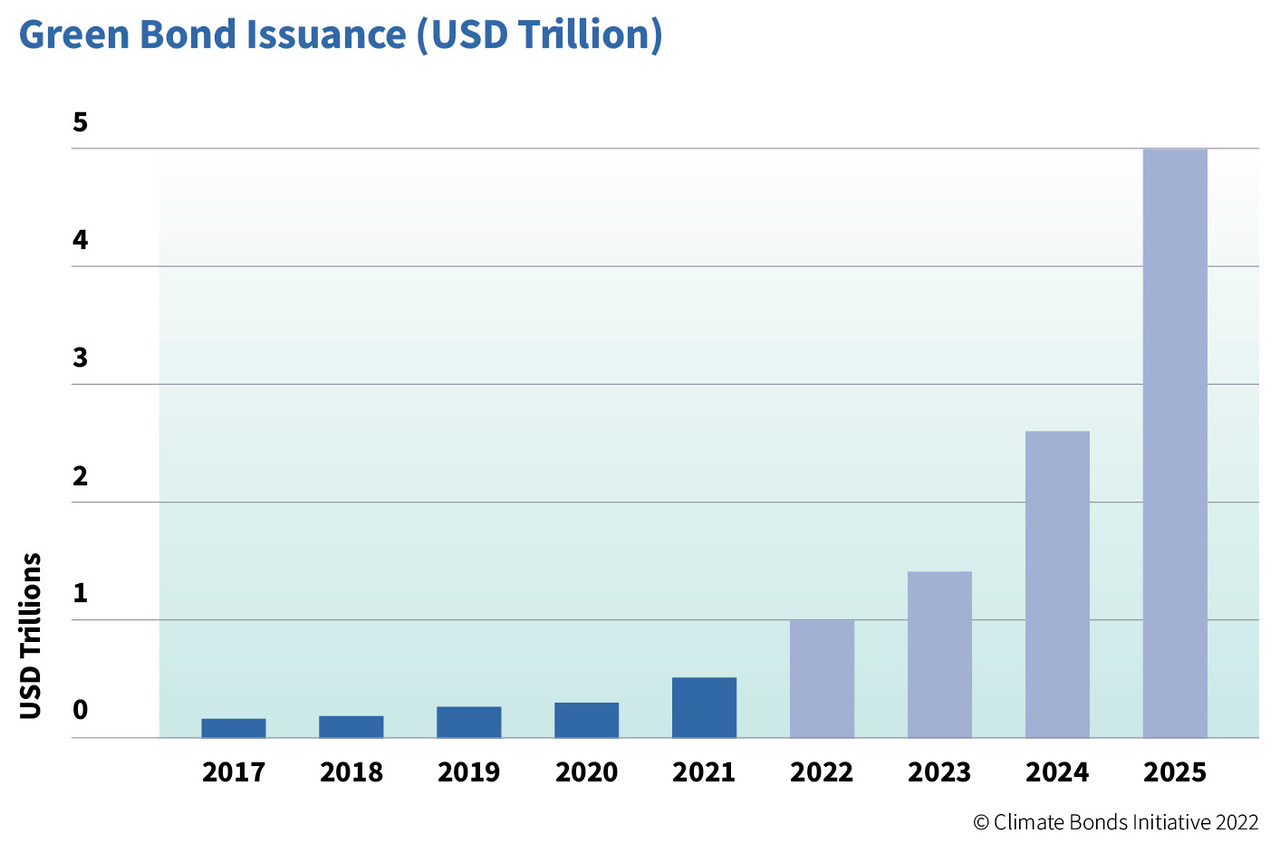

Green Bonds: Financing Environmental Projects

Green bonds play a crucial role in green finance initiatives in the USA. These financial instruments are specifically earmarked for funding environmentally friendly projects. Investors who purchase green bonds are essentially contributing to initiatives such as renewable energy projects, energy efficiency improvements, and sustainable water management.

Financial Inclusion and Sustainability: Bridging Gaps

Green finance initiatives in the USA are not only about environmental considerations but also encompass financial inclusion. These initiatives seek to bridge gaps in access to financial services, ensuring that sustainable finance practices benefit all segments of society. This dual focus on environmental and social sustainability reflects a comprehensive approach to creating a more equitable and sustainable financial system.

The Role of Technology: Fintech Solutions for Sustainability

Technology is a driving force behind green finance initiatives in the USA. Fintech solutions are enabling seamless integration of sustainability criteria into financial services. From digital platforms that facilitate impact investing to blockchain applications that enhance transparency in supply chains, technology is amplifying the impact and reach of sustainable finance.

Consumer Awareness and Education: Shaping Sustainable Choices

The success of green finance initiatives in the USA relies on consumer awareness and education. Individuals are encouraged to make sustainable choices in their financial decisions, from banking and investments to spending habits. Financial institutions are playing a pivotal role in educating their clients about the environmental impact of their choices and the positive outcomes of embracing sustainable finance.

Empowering Change with Green Finance Initiatives USA

For those looking to align their financial choices with sustainability, Green Finance Initiatives USA serve as a valuable resource. CleverScale provides insights, tools, and information to empower individuals in making sustainable financial decisions. By leveraging CleverScale’s expertise, individuals can contribute to the broader movement of green finance and play a role in shaping a more sustainable future.

In conclusion, green finance initiatives in the USA represent a paradigm shift in the financial sector, reflecting a commitment to environmental and social responsibility. From renewable energy investments to sustainable infrastructure development and ESG integration, these initiatives are driving positive change. As individuals become more conscious of their financial choices, the collective impact of green finance can foster a more sustainable and resilient economy. Visit CleverScale to embark on your journey toward sustainable finance today.