Strategic Management of USA Stock Portfolios

Investors seeking sustained success in the dynamic USA stock market must focus on strategic portfolio management. Crafting and maintaining a well-structured portfolio is essential for navigating the complexities of the market and achieving long-term financial goals.

Building a Diversified Portfolio Foundation

Diversification is the bedrock of a resilient USA stock portfolio. Spread across various sectors and asset classes, a diversified portfolio mitigates risk by reducing the impact of poor performance in a single area. Successful investors recognize the importance of balancing high-risk, high-reward assets with more stable investments to achieve a robust and well-rounded portfolio.

Evaluating Risk Tolerance for Informed Decision-Making

Understanding individual risk tolerance is a critical step in managing a USA stock portfolio. Investors must assess their capacity to weather market fluctuations and potential losses. This evaluation guides the selection of suitable investments and the allocation of assets within the portfolio, ensuring a balanced approach that aligns with the investor’s risk appetite.

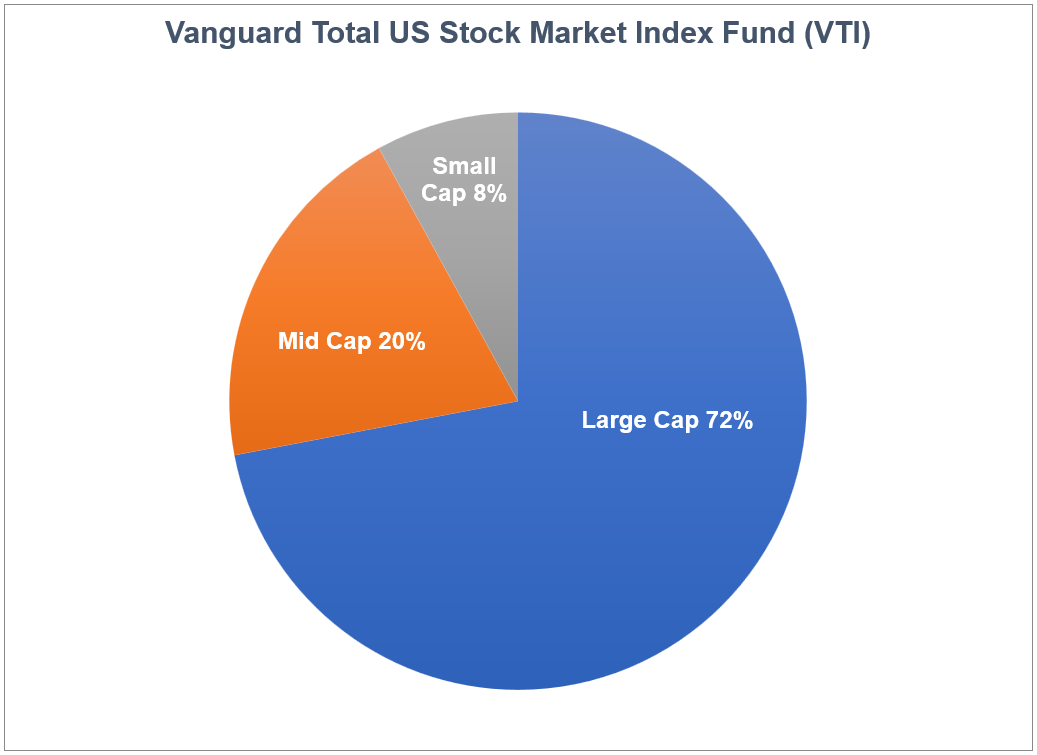

Strategic Asset Allocation for Optimal Returns

Strategic asset allocation involves distributing investments across different asset classes based on their historical performance and expected future returns. By strategically balancing allocations to stocks, bonds, and other assets, investors aim to optimize returns while managing risk. Periodic reassessment and adjustments are crucial to align with changing market conditions and financial goals.

Continuous Monitoring and Portfolio Rebalancing

The financial landscape is ever-changing, necessitating continuous monitoring of a USA stock portfolio. Regular assessments help investors identify underperforming assets, changing market dynamics, and opportunities for adjustments. Portfolio rebalancing ensures that the allocation remains aligned with the investor’s risk tolerance and financial objectives.

Adapting to Market Trends for Portfolio Optimization

Successful portfolio management requires staying attuned to market trends. Investors must analyze the prevailing economic conditions, industry developments, and global events impacting the USA stock market. Adapting the portfolio strategy to capitalize on emerging trends and positioning it defensively during downturns is crucial for long-term success.

Incorporating Sustainable Investments for Long-Term Value

The integration of sustainable investments has gained prominence in USA stock portfolios. Investors increasingly consider environmental, social, and governance (ESG) factors when making investment decisions. Incorporating companies with strong sustainability practices not only aligns with ethical considerations but can also contribute to long-term value creation.

The Role of Dividend Stocks in Income Generation

Dividend stocks play a vital role in income generation within a USA stock portfolio. Companies that consistently pay dividends provide a steady income stream for investors. This income can be reinvested for compounded growth or used as a source of regular cash flow, adding stability to the overall portfolio.

Utilizing Technology and Analytics for Informed Decisions

In the digital age, technology and analytics play a pivotal role in portfolio management. Advanced tools and platforms enable investors to analyze market data, assess the performance of individual assets, and make informed decisions. Incorporating technology in the decision-making process enhances the efficiency and effectiveness of portfolio management.

The Importance of Professional Guidance in Portfolio Management

For investors navigating the complexities of the USA stock market, seeking professional guidance can be invaluable. Financial advisors with expertise in portfolio management can provide personalized strategies, offer insights into market trends, and assist in aligning the portfolio with specific financial goals.

Conclusion: Navigating Success with a Well-Managed USA Stock Portfolio

In conclusion, strategic management of a USA stock portfolio is essential for achieving financial success. Diversification, risk assessment, strategic asset allocation, and continuous monitoring are integral components. Explore more insights and resources on USA Stock Portfolio to enhance your portfolio management skills and navigate the ever-evolving landscape of the USA stock market.