Securing Finances: Financial Security in the USA

Financial security is a cornerstone of well-being, providing individuals and families with stability and peace of mind. In the USA, achieving and maintaining financial security involves strategic planning, informed decision-making, and a commitment to building a resilient financial foundation.

Budgeting and Expense Management

At the heart of financial security is effective budgeting. Creating a detailed budget allows individuals to understand their income, allocate funds to essential expenses, and prioritize savings. Expense management involves tracking spending patterns and making informed choices to live within one’s means.

Emergency Funds: A Safety Net

Building an emergency fund is a fundamental step toward financial security. This fund serves as a safety net during unexpected circumstances, such as medical emergencies or job loss. Financial experts recommend saving three to six months’ worth of living expenses in an easily accessible account.

Smart Investing for Long-Term Growth

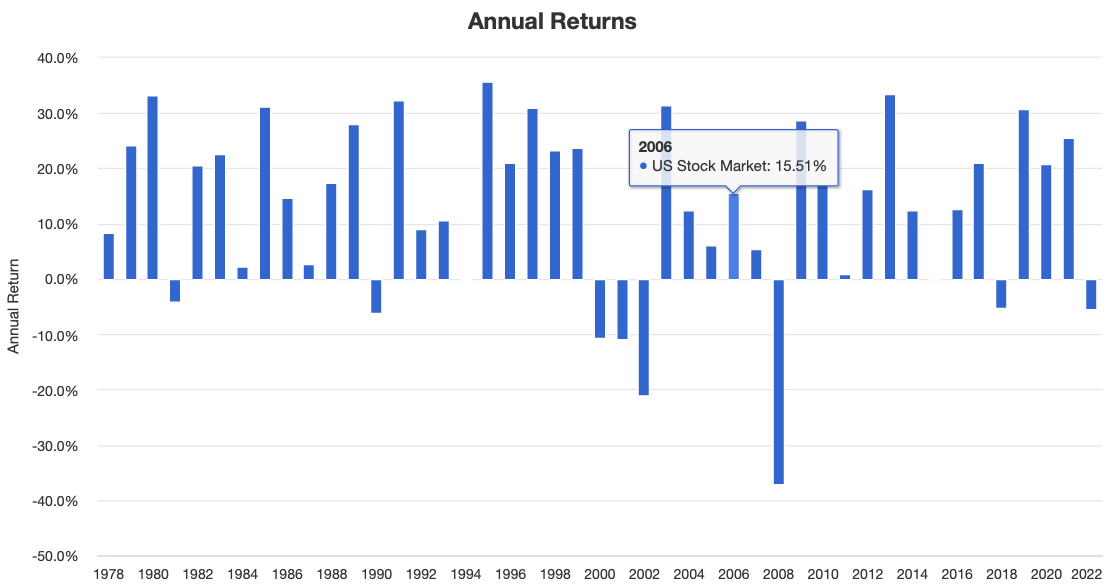

Investing is a key strategy for building wealth and achieving long-term financial security. Individuals in the USA can explore various investment vehicles, such as stocks, bonds, and retirement accounts. Diversification and a long-term perspective are essential for navigating the dynamics of the financial markets.

Debt Management and Credit Health

Managing debt is crucial for financial security. Understanding the terms of loans, credit cards, and other liabilities helps individuals make informed decisions. Maintaining a good credit score is equally important, as it influences borrowing rates and eligibility for loans.

Insurance Coverage for Protection

Insurance plays a vital role in financial security by providing protection against unforeseen events. Health insurance ensures access to medical care without incurring substantial costs. Property and casualty insurance protect assets, while life insurance provides financial support to loved ones in the event of a tragedy.

Retirement Planning: Building a Nest Egg

Planning for retirement is an integral aspect of financial security. Contributing to retirement accounts, such as 401(k) or Individual Retirement Accounts (IRA), ensures a comfortable retirement. Understanding the benefits of employer-sponsored plans and optimizing contributions is key to long-term financial well-being.

Education and Career Development

Investing in education and career development contributes to financial security. Continuous learning and skill development enhance career opportunities and earning potential. Additionally, staying informed about industry trends and job market demands helps individuals adapt to economic changes.

Estate Planning: Securing the Future

Estate planning goes beyond financial security for individuals; it secures the future for generations to come. Creating a will, establishing trusts, and designating beneficiaries ensure that assets are distributed according to one’s wishes. Estate planning also involves considerations for taxes and minimizing financial burdens on heirs.

Financial Education and Literacy

Empowering individuals with financial education is essential for fostering financial security. Understanding basic financial concepts, such as budgeting, investing, and debt management, equips individuals with the knowledge to make sound financial decisions. Accessing resources and workshops on financial literacy contributes to informed decision-making.

Community and Social Support

Building financial security is not solely an individual endeavor. Communities and social support networks play a crucial role. Sharing financial insights, participating in community programs, and accessing support networks can provide valuable perspectives and encouragement on the journey toward financial security.

To explore further insights on achieving financial security in the USA, visit Financial Security USA. The pursuit of financial security is an ongoing journey that requires adaptability and a commitment to financial well-being. By incorporating these strategies and staying informed about personal finance, individuals can navigate the complexities of the financial landscape and build a secure future.