Mastering Stock Valuation in the USA: Key Strategies for Success

Embarking on the journey of stock valuation in the USA requires a nuanced understanding of market dynamics, financial metrics, and strategic analysis. In this article, we delve into key strategies to master the art of stock valuation in the dynamic landscape of the USA market.

Understanding the Foundations of Stock Valuation

At the core of successful stock valuation is a deep understanding of the foundations. Investors need to grasp the basic principles of valuation, including earnings, cash flow, and book value. Recognizing the relevance of these fundamental metrics sets the stage for more advanced valuation techniques.

Earnings-Based Valuation Metrics

One of the most widely used approaches to stock valuation is based on earnings metrics. This includes the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. Understanding the nuances of P/E ratios and similar metrics provides valuable insights into a company’s perceived value by the market.

Cash Flow Analysis for In-Depth Insight

Cash flow analysis is a powerful tool in stock valuation. Investors assess a company’s ability to generate cash, which is often a more reliable indicator of financial health than earnings alone. By examining operating cash flow, free cash flow, and their trends, investors gain in-depth insight into a company’s financial strength.

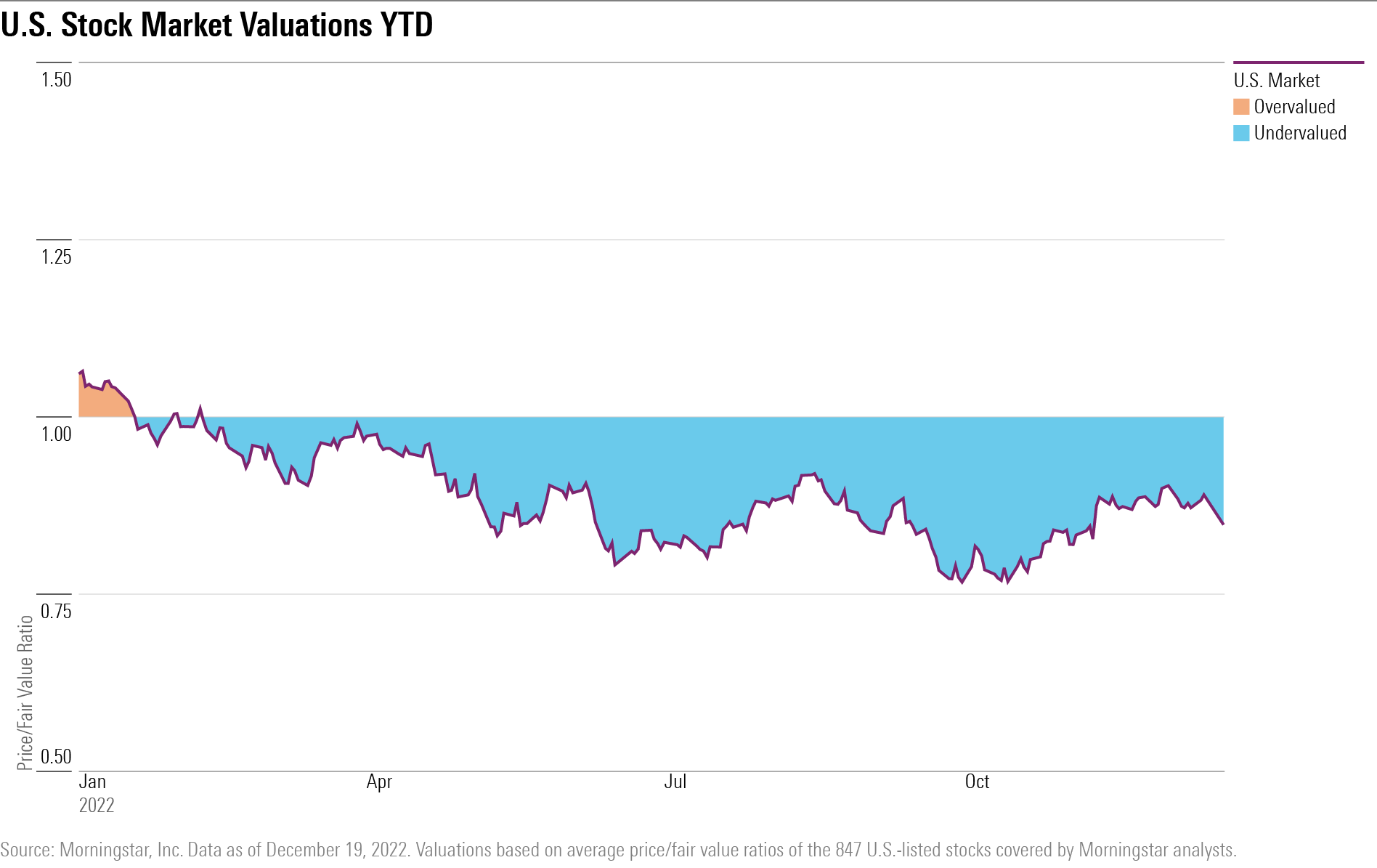

Book Value and Asset-Based Valuation

Book value, representing a company’s net assets, is another essential metric in stock valuation. Comparing a company’s market value to its book value provides insights into whether a stock is undervalued or overvalued. Asset-based valuation considers a company’s tangible and intangible assets, offering a comprehensive view of its worth.

Understanding Growth Metrics

Stock valuation is inherently tied to a company’s growth potential. Investors should analyze growth metrics such as revenue growth, earnings growth, and the potential for future expansion. A comprehensive evaluation of a company’s growth prospects contributes to a more accurate valuation assessment.

Industry and Peer Comparison

Valuing a stock in isolation might provide an incomplete picture. Investors should consider industry benchmarks and peer comparisons to contextualize a company’s valuation. Understanding how a stock fares relative to its industry and peers helps investors assess its competitive position.

Discounted Cash Flow (DCF) Analysis

For a more sophisticated approach to stock valuation, the discounted cash flow (DCF) analysis is invaluable. DCF models project a company’s future cash flows and discount them back to present value. While complex, DCF analysis provides a detailed and forward-looking assessment of a stock’s intrinsic value.

Market Sentiment and Behavioral Factors

Beyond numerical metrics, stock valuation is influenced by market sentiment and behavioral factors. Investor perceptions, news, and sentiment can impact stock prices. Successful valuation strategies incorporate an awareness of market dynamics and behavioral aspects to make more informed predictions.

Risk Assessment in Valuation

Every stock valuation strategy should include a comprehensive risk assessment. Investors need to identify and evaluate risks associated with a particular stock, industry, or market conditions. Factoring in risk considerations ensures a more realistic and robust valuation.

Continuous Monitoring and Adjustments

Stock valuation is not a one-time event; it requires continuous monitoring and adjustments. Economic conditions, industry trends, and company performance evolve over time. Successful investors regularly reassess their stock valuations to align with changing circumstances and make timely adjustments.

Conclusion: Mastering Stock Valuation in the USA

In conclusion, mastering stock valuation in the USA involves a blend of financial acumen, strategic analysis, and continuous adaptation. By understanding foundational principles, employing various valuation metrics, and considering both quantitative and qualitative factors, investors can navigate the complexities of the stock market. Explore more insights and resources on Stock Valuation USA to refine your strategies and enhance your prowess in stock valuation.