Empower Your Finances: Personal Finance Tips for USA Residents

Navigating the complexities of personal finance is a journey that requires knowledge, discipline, and strategic planning. In the context of the United States, where financial landscapes can be diverse, understanding key personal finance tips can pave the way for financial well-being.

Create a Comprehensive Budget

The foundation of sound personal finance is a well-constructed budget. Establishing a comprehensive budget that outlines income, expenses, savings, and debt payments provides a clear overview of your financial situation. Budgeting allows for informed decision-making and ensures that financial goals are aligned with your income.

Prioritize Emergency Savings

Unexpected expenses are inevitable, and having a robust emergency fund is crucial. Aim to save three to six months’ worth of living expenses in a readily accessible account. This financial cushion provides peace of mind and financial stability during unforeseen circumstances such as job loss or medical emergencies.

Explore Personal Finance Tips for USA residents at www.cleverscale.com

Understand and Manage Debt Wisely

Debt can be a tool, but managing it wisely is essential. Prioritize high-interest debts and work towards paying them off. Understand the terms of loans and credit cards, and strive to maintain a healthy credit score. Responsible debt management is key to financial freedom.

Invest for the Future

Investing is a powerful tool for wealth building. Consider long-term investment strategies aligned with your financial goals. Utilize tax-advantaged accounts such as 401(k)s and IRAs for retirement savings. Diversify your investments to mitigate risk and explore opportunities for growth.

Stay Informed About Retirement Planning

Retirement planning is a critical aspect of personal finance. Understand the retirement accounts available, contribute consistently, and take advantage of employer-sponsored plans. Regularly review and adjust your retirement strategy to ensure it aligns with your evolving financial goals.

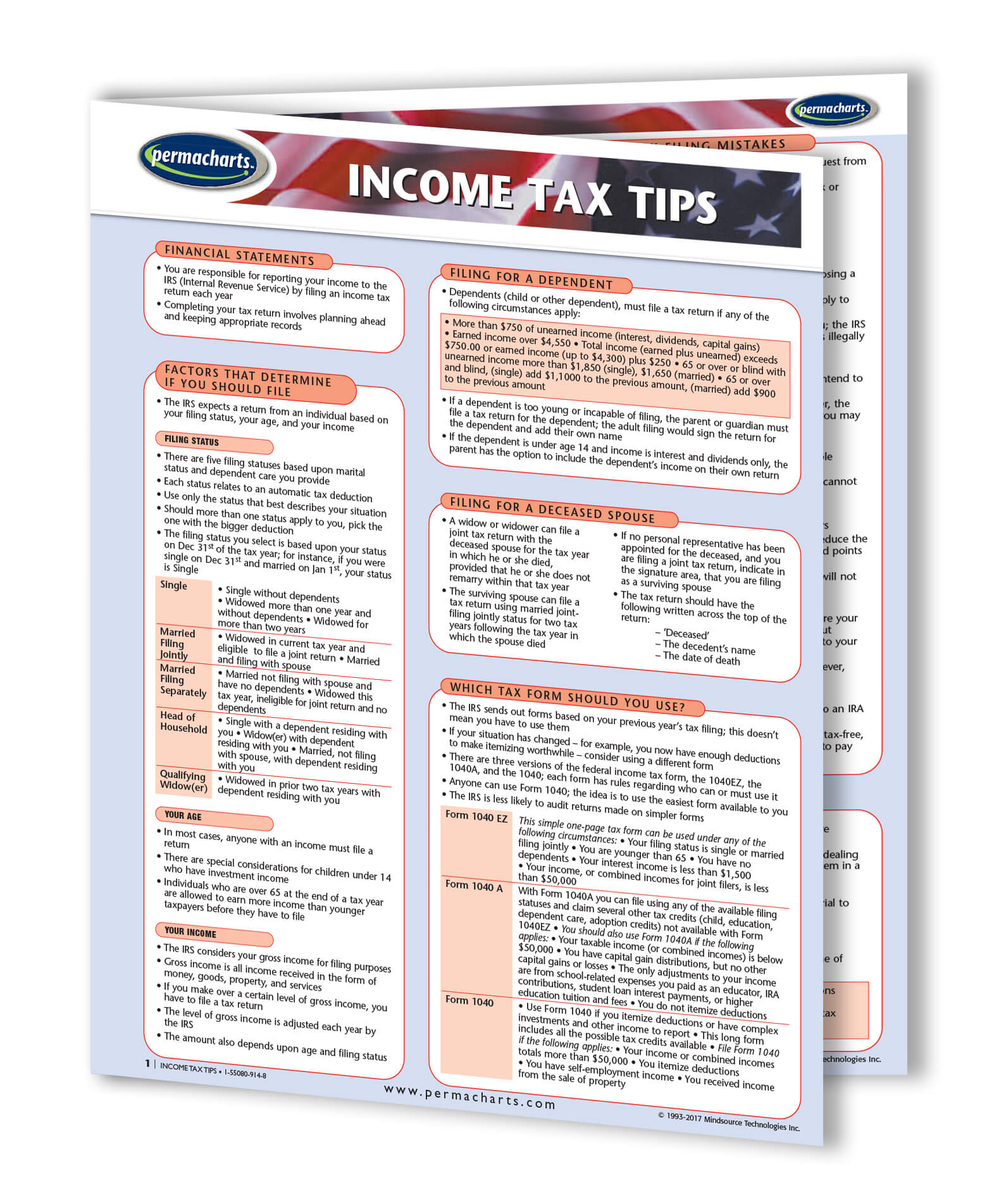

Optimize Tax Planning

Efficient tax planning can maximize your financial resources. Stay informed about available tax deductions, credits, and incentives. Leverage tax-advantaged accounts for savings and investments. Consider consulting a tax professional to optimize your tax strategy and minimize liabilities.

Review and Adjust Insurance Coverage

Insurance is a fundamental component of financial security. Regularly review your insurance policies, including health, life, and property insurance. Ensure that coverage aligns with your current needs and circumstances. Adequate insurance provides a safety net for unexpected events.

Explore Opportunities for Additional Income

Supplementing your primary income with additional streams can accelerate your financial goals. Explore opportunities for side hustles, freelance work, or passive income streams. Diversifying your income sources enhances financial resilience and provides more avenues for savings and investments.

Set Specific Financial Goals

Define clear and achievable financial goals. Whether it’s saving for a home, funding education, or retiring comfortably, setting specific goals provides direction for your financial journey. Break down larger goals into smaller, actionable steps to track progress and stay motivated.

Cultivate Financial Literacy

Invest time in expanding your financial knowledge. Stay informed about personal finance trends, investment strategies, and economic developments. Cultivating financial literacy empowers you to make informed decisions, navigate financial challenges, and take advantage of opportunities.

Regularly Review and Adjust Your Plan

Personal finance is dynamic, and your financial plan should evolve with changing circumstances. Regularly review your budget, investments, and financial goals. Adjust your plan as needed to stay on track and ensure that your financial strategy aligns with your life priorities.

In conclusion, empowering your finances in the USA involves a combination of prudent budgeting, strategic saving and investing, and staying informed about financial opportunities. By incorporating these personal finance tips into your lifestyle, you can build a solid financial foundation for a secure and prosperous future.

Explore Personal Finance Tips for USA residents at www.cleverscale.com.