Strategies for Informed Investing: Navigating Stock Valuation in the USA

The world of stock valuation in the United States is a complex yet critical aspect of informed investing. Understanding the strategies behind evaluating stocks is key for investors looking to make sound financial decisions. In this article, we delve into the nuances of stock valuation in the USA and explore effective strategies to navigate this dynamic landscape.

The Basics of Stock Valuation

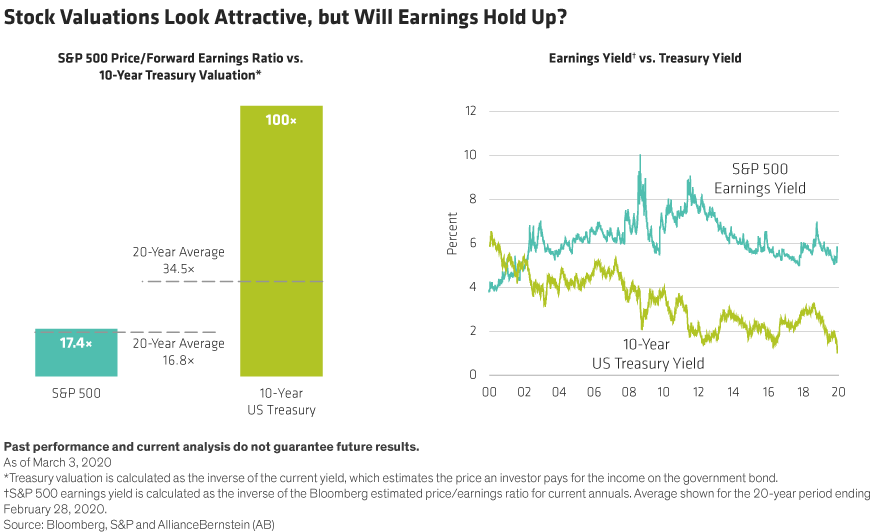

Stock valuation involves assessing the intrinsic value of a company’s stock, aiming to determine whether it is overvalued or undervalued in the market. Fundamental analysis plays a crucial role, considering factors such as earnings, financial health, and growth potential. Investors use various metrics, such as price-to-earnings ratio (P/E), to gauge the attractiveness of a stock.

Economic Indicators and Market Trends

Evaluating economic indicators and understanding market trends are integral components of stock valuation. Economic indicators, including GDP growth and unemployment rates, impact overall market conditions. Recognizing market trends helps investors anticipate potential shifts in stock values. Staying informed about these factors provides a comprehensive view for making informed investment decisions.

Technological Advancements in Valuation Methods

Advancements in technology have significantly influenced stock valuation methods. Machine learning algorithms and sophisticated analytical tools enable investors to process vast amounts of data quickly. Technology not only streamlines the valuation process but also enhances accuracy, allowing investors to make more informed choices.

Comparative Analysis: Peer Benchmarking

Comparative analysis involves benchmarking a company’s valuation against its industry peers. This method provides valuable insights into a stock’s relative strength and weaknesses within its sector. Examining how a company stacks up against competitors is essential for making nuanced investment decisions.

Dividend Discount Model (DDM) and Cash Flow Analysis

The Dividend Discount Model (DDM) and cash flow analysis are fundamental techniques in stock valuation. DDM calculates a stock’s fair value based on expected future dividends. Cash flow analysis assesses a company’s ability to generate positive cash flow, indicating its financial stability. Both models are critical for determining the intrinsic value of a stock.

Challenges in Stock Valuation

While stock valuation is a powerful tool, it comes with its own set of challenges. Market volatility, unexpected economic events, and sudden industry shifts can complicate the valuation process. Overcoming these challenges requires a strategic approach and a deep understanding of the factors influencing stock prices.

Risk Management in Stock Valuation

Effective risk management is paramount in stock valuation. Investors must be aware of the risks associated with their chosen valuation methods and constantly monitor their portfolios. Diversification and setting realistic expectations are key components of a robust risk management strategy in the ever-changing landscape of stock valuation.

Long-Term Perspective: Beyond Short-Term Gains

Successful stock valuation goes beyond short-term gains. Investors with a long-term perspective consider a company’s growth potential and sustainability. Focusing on stocks with strong fundamentals and growth prospects can lead to sustained returns over the years.

Strategies for Informed Investing

Informed investing in the realm of stock valuation involves a combination of thorough research, technological utilization, and a disciplined approach. Investors looking for insights into USA Stock Valuation can explore the comprehensive analysis provided by CleverScale. CleverScale offers a wealth of information and tools to empower investors in making informed decisions in the dynamic landscape of the US stock market.

In conclusion, navigating stock valuation in the USA requires a multifaceted approach. By understanding the basics, leveraging technology, conducting comparative analyses, and embracing a long-term perspective, investors can enhance their ability to make informed decisions in the ever-evolving world of stock valuation.