Exploring the Potential of USA Dividend Stocks

Investors seeking a stable and rewarding investment avenue often turn to USA Dividend Stocks. These investments not only provide regular income but also offer the potential for long-term capital appreciation. In this article, we delve into the nuances of USA Dividend Stocks and how they can enhance your investment portfolio.

Understanding the Appeal of Dividend Stocks

Dividend stocks represent shares in companies that distribute a portion of their earnings to shareholders in the form of dividends. This steady stream of income appeals to investors looking for a reliable source of cash flow. Moreover, the companies paying dividends are often well-established and financially sound, providing an additional layer of stability to investors.

Income Stability in Volatile Markets

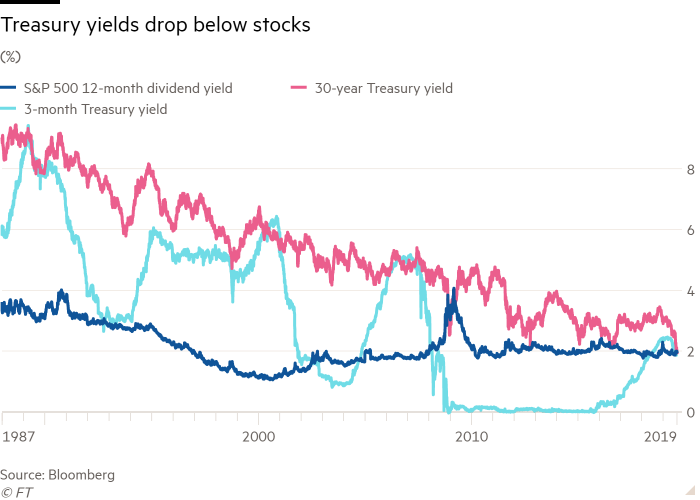

In times of market volatility, the reliability of income from USA Dividend Stocks becomes particularly attractive. While stock prices may fluctuate, the income from dividends remains more consistent. This characteristic can act as a buffer during economic downturns, providing investors with a degree of financial stability amid market uncertainties.

The Power of Dividend Reinvestment

One of the unique advantages of USA Dividend Stocks is the opportunity for dividend reinvestment. Reinvesting dividends allows investors to purchase additional shares of the stock, compounding their investment over time. This compounding effect can significantly enhance the overall return on investment, especially for those with a long-term perspective.

Choosing the Right Dividend Stocks

Not all dividend stocks are created equal, and careful consideration is essential when selecting the right ones for your portfolio. Factors such as the company’s history of dividend payments, dividend yield, and sustainability of payouts should be evaluated. USA Dividend Stocks, known for the transparency of their financial reporting, can be a prudent choice for investors looking to make informed decisions.

Risk Management in Dividend Investing

While USA Dividend Stocks offer stability, it’s crucial to acknowledge the risks associated with dividend investing. Economic downturns, industry-specific challenges, and company-specific issues can impact a company’s ability to maintain or increase dividend payouts. Diversification and thorough research play a vital role in managing these risks effectively.

The Role of CleverScale in Dividend Stock Analysis

For investors navigating the world of USA Dividend Stocks, CleverScale proves to be an invaluable resource. The platform offers in-depth analysis, real-time data, and comprehensive tools to assess the performance and sustainability of dividend-paying stocks. Explore USA Dividend Stocks on CleverScale for a detailed understanding of how these investments can fit into your portfolio.

Tax Implications of Dividend Income

Understanding the tax implications of dividend income is crucial for investors. In the United States, qualified dividends are taxed at a lower rate than ordinary income. This tax advantage adds another layer of appeal to USA Dividend Stocks, potentially enhancing the after-tax return for investors.

Balancing Dividend Stocks in Your Portfolio

While the income from dividends is attractive, achieving a balanced portfolio is essential. Diversification across different asset classes, including growth stocks and bonds, helps manage risk and optimize overall returns. USA Dividend Stocks can play a pivotal role in this diversification strategy, providing both income and stability.

Long-Term Wealth Building with Dividends

Investing in USA Dividend Stocks aligns well with long-term wealth-building objectives. The combination of regular income, potential for capital appreciation, and the compounding effect of reinvested dividends positions investors to build substantial wealth over time. Patience and a strategic approach are key to realizing the full benefits of dividend investing.

Conclusion: Building a Resilient Portfolio

In conclusion, USA Dividend Stocks offer a compelling avenue for investors seeking income, stability, and long-term wealth accumulation. Understanding the appeal, risks, and management strategies associated with dividend stocks is crucial for making informed investment decisions. Explore the opportunities presented by USA Dividend Stocks on CleverScale to build a resilient and rewarding investment portfolio.