USA Growth Stocks: Navigating Opportunities for Investors

Investors seeking capital appreciation often turn their attention to growth stocks, known for their potential to outperform the market. In this exploration, we delve into the dynamics of USA growth stocks, examining their characteristics, benefits, and considerations for investors eyeing opportunities in the growth-oriented segment.

Understanding the Essence of Growth Stocks

At the heart of growth stocks lies the promise of above-average growth compared to other companies in the market. This paragraph breaks down the fundamental characteristics of growth stocks, emphasizing traits such as strong earnings growth, revenue expansion, and a focus on innovation. Investors are drawn to growth stocks for their potential to deliver substantial returns over time.

At USA Growth Stocks, investors can explore a curated selection of promising growth stocks to consider for their portfolios.

Technological Innovation: A Driving Force for Growth

One defining feature of many USA growth stocks is their association with technological innovation. This section explores how companies at the forefront of technological advancements often fall into the growth stock category. Investors keen on cutting-edge developments find growth stocks in sectors like tech, biotech, and renewable energy particularly appealing.

Evaluating Risk and Reward in Growth Investing

While the potential for high returns is a lure for growth investors, it’s crucial to address the associated risks. This paragraph discusses the risk-reward dynamics in growth investing, emphasizing the importance of thorough research, diversification, and an understanding of market volatility. Effective risk management is key for investors navigating the growth stock landscape.

The Role of Earnings Growth in Identifying Winners

Earnings growth is a pivotal metric when evaluating growth stocks. This section explores how investors can analyze a company’s earnings history and growth projections to identify potential winners. Companies consistently demonstrating robust earnings growth are often considered prime candidates for inclusion in a growth-focused portfolio.

Considerations for Building a Growth-Oriented Portfolio

Building a portfolio centered around growth requires thoughtful consideration. This paragraph outlines key considerations, including sector diversification, investment horizon, and the alignment of growth stocks with an investor’s risk tolerance. Tailoring the portfolio to individual preferences and goals is essential for a successful growth-oriented investment strategy.

At USA Growth Stocks, investors can access tools and resources to aid in the construction of a well-balanced growth-focused portfolio.

Market Conditions and Growth Stock Performance

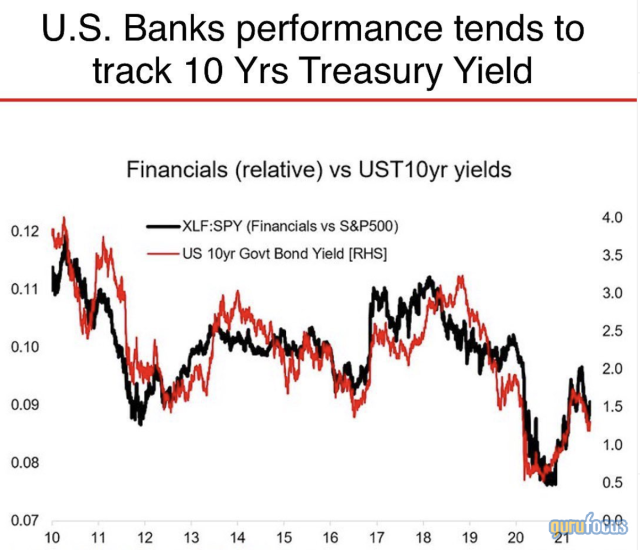

Growth stocks can respond differently to various market conditions. This section explores how factors like interest rates, economic indicators, and market sentiment can influence the performance of growth stocks. Investors should stay informed about broader market trends to make strategic decisions within their growth portfolios.

IPOs and New Entrants in the Growth Stock Arena

Newly public companies often bring fresh opportunities for growth investors. This paragraph delves into the role of initial public offerings (IPOs) and emerging companies in the growth stock arena. Investors seeking potential high-growth opportunities may find value in exploring newly listed stocks and industry disruptors.

Environmental, Social, and Governance (ESG) Considerations

The integration of ESG factors is increasingly becoming a focal point for investors. This section explores how ESG considerations align with growth investing, emphasizing the importance of sustainable and responsible practices. Many growth investors now prioritize companies with a strong commitment to ESG principles.

Continuous Monitoring and Adaptation in Growth Investing

The dynamic nature of growth stocks necessitates continuous monitoring. This paragraph emphasizes the importance of staying updated on company developments, industry trends, and market dynamics. Growth investors should be prepared to adapt their strategies as conditions evolve to ensure the ongoing success of their investments.

Conclusion: Navigating Growth Opportunities with USA Growth Stocks

In conclusion, USA growth stocks present an enticing landscape for investors seeking capital appreciation. With characteristics rooted in innovation, earnings growth, and potential for substantial returns, growth stocks can play a pivotal role in a well-diversified portfolio. Exploring opportunities at USA Growth Stocks provides investors with the resources and insights needed to navigate the dynamic and promising world of growth investing.